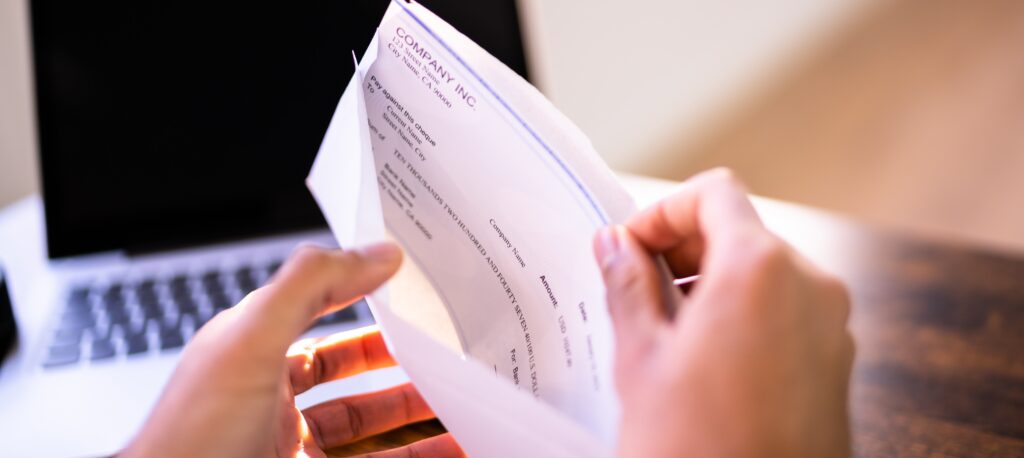

In 2024, businesses experienced a significant rise in check fraud, with FinCEN reporting a 400% increase in mail theft-related check fraud. This type of fraud occurs when someone steals checks from the mail and maliciously alters them.

Criminals often target outgoing checks placed in standard mailboxes, intercepting them before delivery. Once stolen, checks may be altered to change the payee name and/or dollar amount and then deposited or cashed fraudulently.

While this type of fraud is not new, it continues to be a growing concern.

To help protect your business, we recommend the following best practices:

- Limit the Use of Checks: Consider switching to secure electronic payment methods like ACH or wire transfers for regular transactions.

- Mail Securely:

- Use USPS drop boxes located inside post offices when sending checks.

- Avoid leaving outgoing mail in unsecured locations, especially overnight or on weekends.

- Implement Positive Pay: This service compares checks presented for payment against those you’ve issued, helping detect and block altered or unauthorized items.

- Monitor Account Activity: Check your account transactions daily to quickly spot and report any suspicious activity.

- Verify Receipt of Checks: When mailing checks to vendors or clients, follow up to confirm they’ve been received and deposited without issue.

If you’d like to discuss additional fraud prevention tools (like Positive Pay) or explore ways to enhance your payment security, our team is here to help. Please reach out to our Treasury Management department.

Leave A Comment