Electronic forms of payment are common in today’s purchasing environment. And, with more U.S. consumers electing to pay for services online, the use of ACH transactions has become a viable and widely accepted form of making payments.

Because ACH transactions offer substantial cost savings for businesses (as opposed to paying fees to process credit card payments), many businesses are offering, or in some cases encouraging, customers to pay with a preauthorized ACH debit to their bank account.

Because ACH transactions offer substantial cost savings for businesses (as opposed to paying fees to process credit card payments), many businesses are offering, or in some cases encouraging, customers to pay with a preauthorized ACH debit to their bank account.

But, some consumers are still uneasy about having their bank account drafted.

If you’re thinking about taking the plunge and paying with an ACH debit, here’s some information we thought you might like to know.

Setup an “alert” on your account. It literally takes 15 seconds.

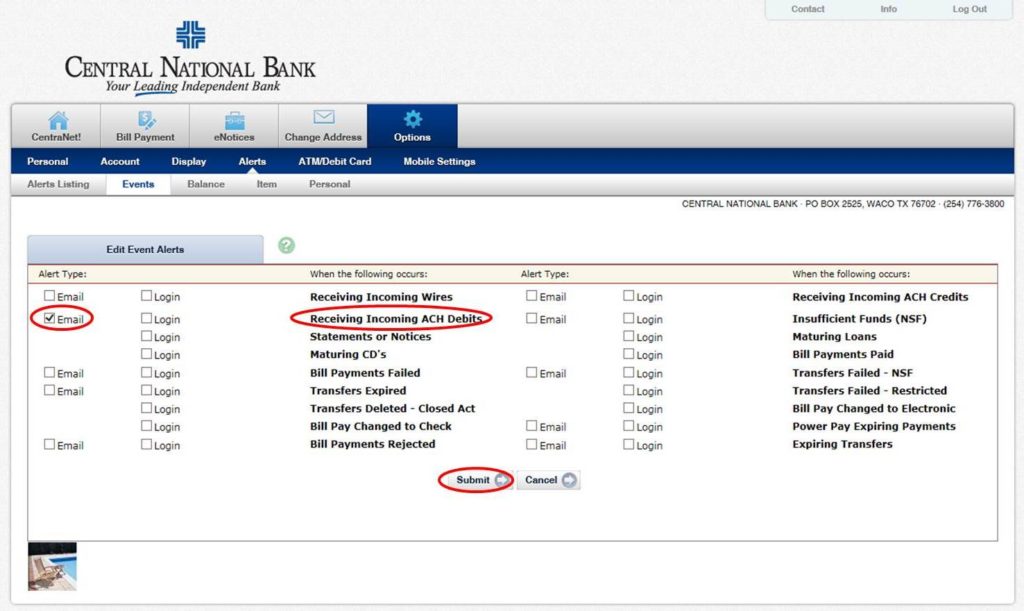

With today’s technology, it’s easier than ever to keep track of your bank accounts, and creating a simple alert for certain “events” is a great way to monitor your account activity. Alerts can be set up by logging into online banking. Central National Bank customers can create alerts by following these quick steps:

- Log into CentraNet

- Select “Options”

- In the blue bar below, select “Alerts”

- On the right side of the screen, select “Edit Event Alerts”

- Next to “Receiving Incoming ACH Debits,” check the “Email” box

- Select “Submit” at the bottom

You’ll now start receiving email notifications anytime an ACH debit posts to your account(s). That wasn’t so hard, was it? But, that leads to another question. What do you do if an unauthorized debit posts to your account?

Notice something out of the ordinary? Just let us know.

If you observe an unauthorized ACH debit on your account, please notify the bank immediately. With most ACH debits (to personal checking/savings accounts), there is a window of time during which the transaction can be returned. And, just because an unauthorized transaction posts to your account doesn’t necessarily mean that your account information is compromised. So, there’s no need to panic.

When you call the bank to report the transaction, you’ll most likely be asked to complete a Written Statement of Unauthorized Debit form, certifying that you did not authorize the transaction. A member of our Customer Service team will then work with you to determine what steps we should take to prevent future unauthorized transactions and/or close the account and open a new one.